4 levels of chatbots in banking

How good are AI conversational chatbots at mimicking human agents – customer support and sales representatives?

The level at which bots are able to understand customers and meaningfully converse with them is a key factor in categorizing chatbots. With advancements in machine learning algorithms and language understanding, chatbots can today converse more effectively with customers in natural language.

In this post, we have listed the different levels of chatbots available for enterprises, what they can do and where they would fit. We’ll discuss specific banking processes that AI Chatbots for Banking can automate for maximum impact without risk to the business or customer experience.

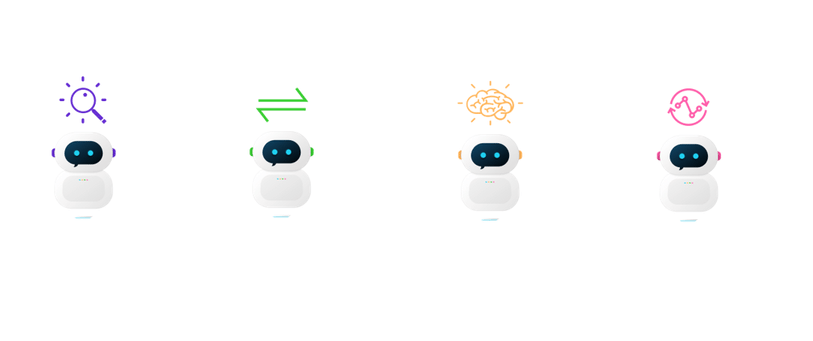

Discovery or Basic Chatbots

This bot is similar to an FAQ page on a website. A discovery bot can be programmed to learn all publicly available information – products, services, branch locations, ATM locations, contact information, etc., and even operational processes as long as they are available on the internet. When a customer or prospect asks a question, this bot can provide answers from the knowledge base or provide links to relevant pages on your company website.

For example, a customer might ask “What are the benefits of a platinum travel card?” and the bot will provide a link/URL to the benefits section of the platinum travel card on your bank website. Or the customer might ask “Is there a branch at XYZ location?” or “What is the phone number for the bank branch at XYZ location” and the bot will immediately display the information in the chat window or say it over the phone.

Discovery bots are used in customer service and are capable of answering basic and repetitive inquiries, freeing up time for support representatives to focus on value-added interactions.

Transactional Chatbots

This bot interacts with customers to help them conduct transactions – pay bills, shop or make purchases, book a cab, book flights, etc. It usually guides the user step-by-step to complete transactions or uses its learning from the customer’s history to complete a transaction automatically. For example, a customer might simply say “Pay my Amex bill” and the bot automatically initiates a transfer to your Amex card account. Or the customer might say “Book a cab to go home” and the bot automatically books an Uber based on what the customer did previously.

At an advanced level, this bot can analyze transactional data and present information in segments or clusters. For example, Customers can ask the bot for their shopping expenses in a month, travel expenses, there monthly spend on entertainment, etc.

Transactional bot delivers seamless customer experiences on banking transactions by increasing convenience and providing quick responses.

Intelligent Chatbots

The intelligent chatbot offers specific, personalized assistance to customers based on data it accesses from enterprise systems such as CRM. This bot is intuitive and understands the context to suggest solutions or products that the user might be looking for – applying for a loan or a credit card, opening a new account, etc. For example, a customer might ask “What is the interest rate for CD?” and the bot will respond with “It is 0.25% for a 12-month term. Would you like to know the interest rate for different term length?” and so on. Based on responses the bot will then assist the customer in applying online and send notifications once the Certificate of Deposit is approved.

An omnichannel intelligent bot, such as provided by Payjo, carries context from one channel to another to complete the application process. For example, if the customer initiates a loan application process on the website and had to drop-off, the next time he calls an IVRS the bot would recognize the registered phone number and ask the customer if he/she would like to continue with the loan application process.

Intelligent bots are used in sales and marketing to convert inquiries by prospects, cross-sell/up-sell to customers and smart on-boarding of customers and employees (sign-up for a demo of Payjo to understand how we can automate the process of onboarding new employees and customers).

Predictive Chatbots

These chatbots predict customer intent and offer specific help or advice – a product or service suggestion – proactively. For example, a predictive bot might say “Hi, you have surplus funds in your account. May I suggest opening an IRA?” Or it could advise you to start saving for your kids’ college fund. Or it could be one of many other helpful suggestions you may or may not have thought of.

Integrating predictive analytics into the AI agent equips it to intelligently recommend products and services that customers need the most — ahead of time. A number of progressive financial institutions are testing predictive agents, especially in investment and wealth management.

A chatbot’s capability or level often depends on the quantity and quality of data that is available for it to process and analyze. Data would include customer profile, transaction history, behavioral, CSAT etc. With the right data, an intelligent chatbot can learn, understand and converse at near-human levels to provide optimal experiences for your customers. While data quantity and quality is a key requirement, AI agents that use multi-level data models (such as Payjo’s) can still achieve a high-level of human-like emulation even with fewer data.

All of the above banking chatbots can meet customer expectations for convenience and quick response. They can be scaled to handle thousands of conversations in parallel and help reduce your firm’s operating costs. So, your choice of AI chatbot will depend on the level of personalization and complexity of tasks you would want the virtual agent to handle.

Sign-up for a demo of Payjo to see our AI chatbots and voice bots in action.

Discover the Latest Insights on Interactive Intelligence for Banking Newsletter

Join the newsletter to receive the latest updates in your inbox.