Improve Customer Experience using AI Assistant

Context-aware, personalized and Intelligent AI conversations on all banking channels

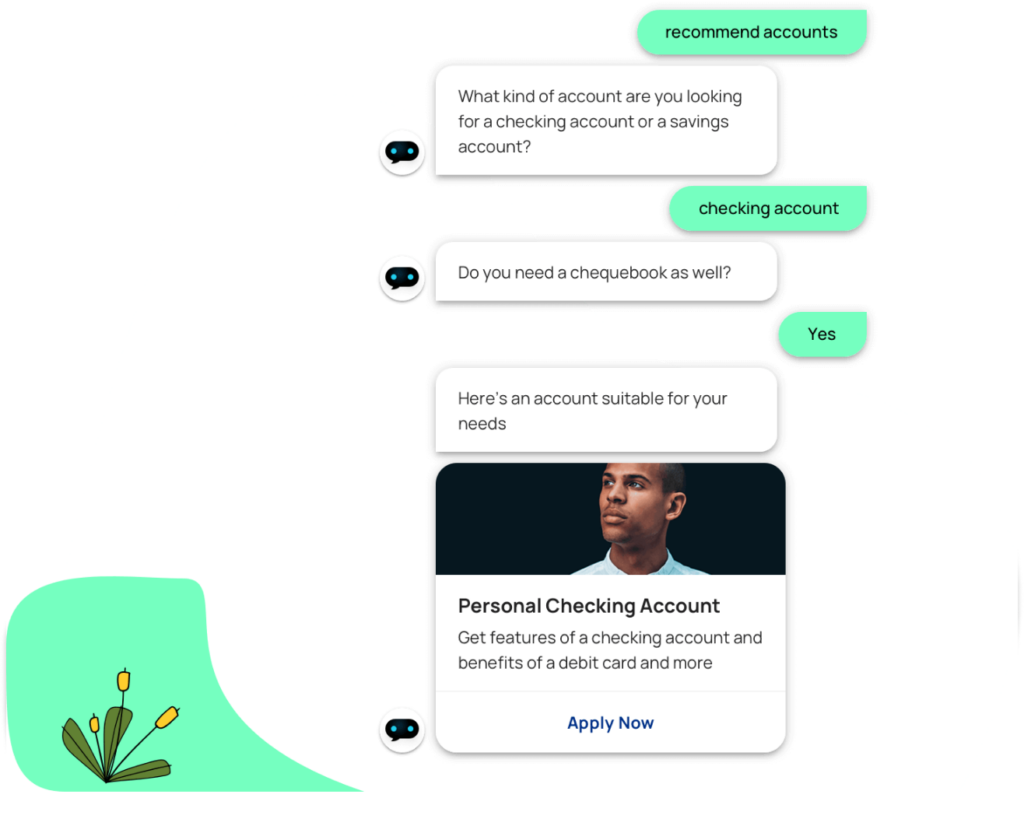

Smart Discovery

Assist customers in getting information & selecting products and services based on their needs without any hassle.

With vast information available on the public domain, customers struggle to find the information relevant to them.

With Smart Discovery, you can enable your customers to find information they want, instantly, on any banking channel, either through text or voice.

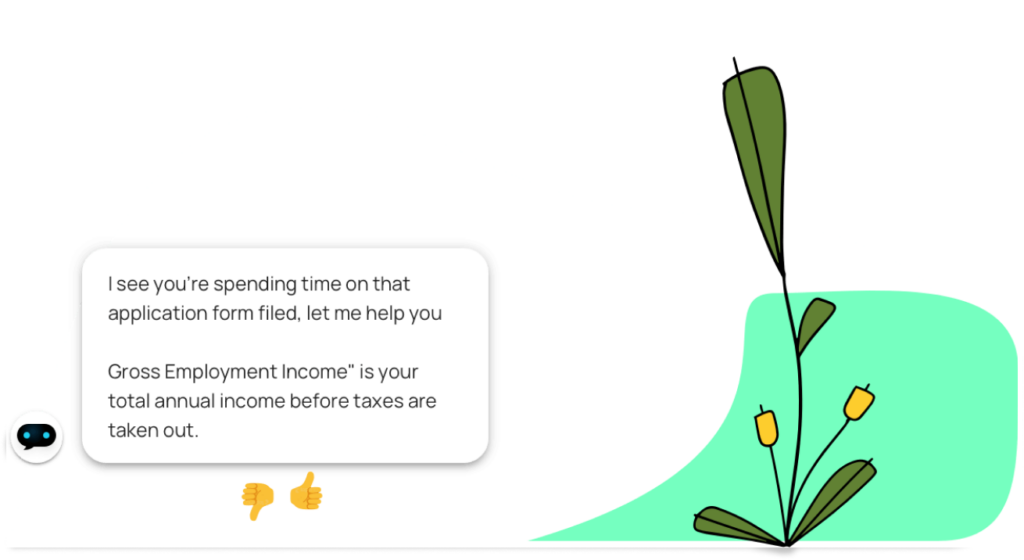

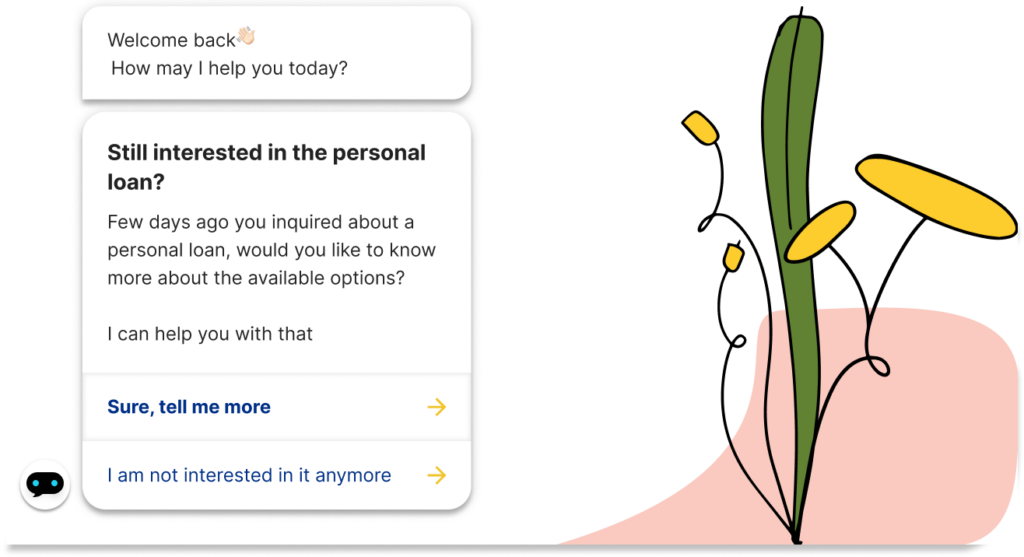

Smart Conversion

Assist customers in applying for Banking products in a natural conversational manner.

Prevent customer drop-offs with timely support and reminders across all banking channels.

Smart Conversion is proven to reduce form drop-offs, and improve conversion of online product purchases by over 500%, and positively impact revenue growth.

Smart Transactions

Enable customers to seamlessly transact and perform account actions across any preferred banking channels.

Before servicing any request that requires authentication, the system will authenticate the customer using the authentication method(s) prescribed by the financial institution.

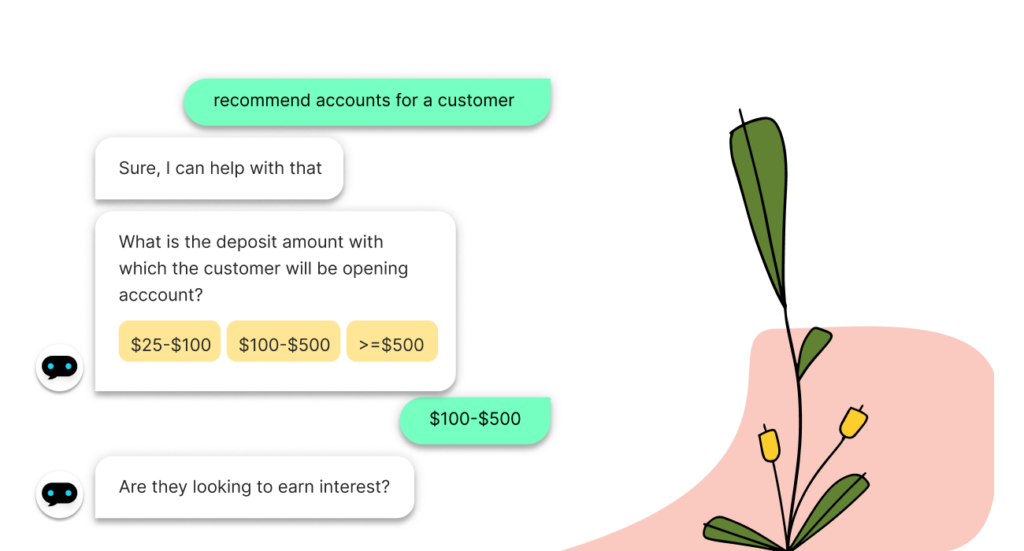

Intelligent Banking

Proactively recommend the right product to customers & prospects by understanding their preference.

interface.ai’s platform analyzes the wealth of data gathered from all the channels to predict your customers’ & prospects’ behavior to minimize future risks and maximize opportunities.

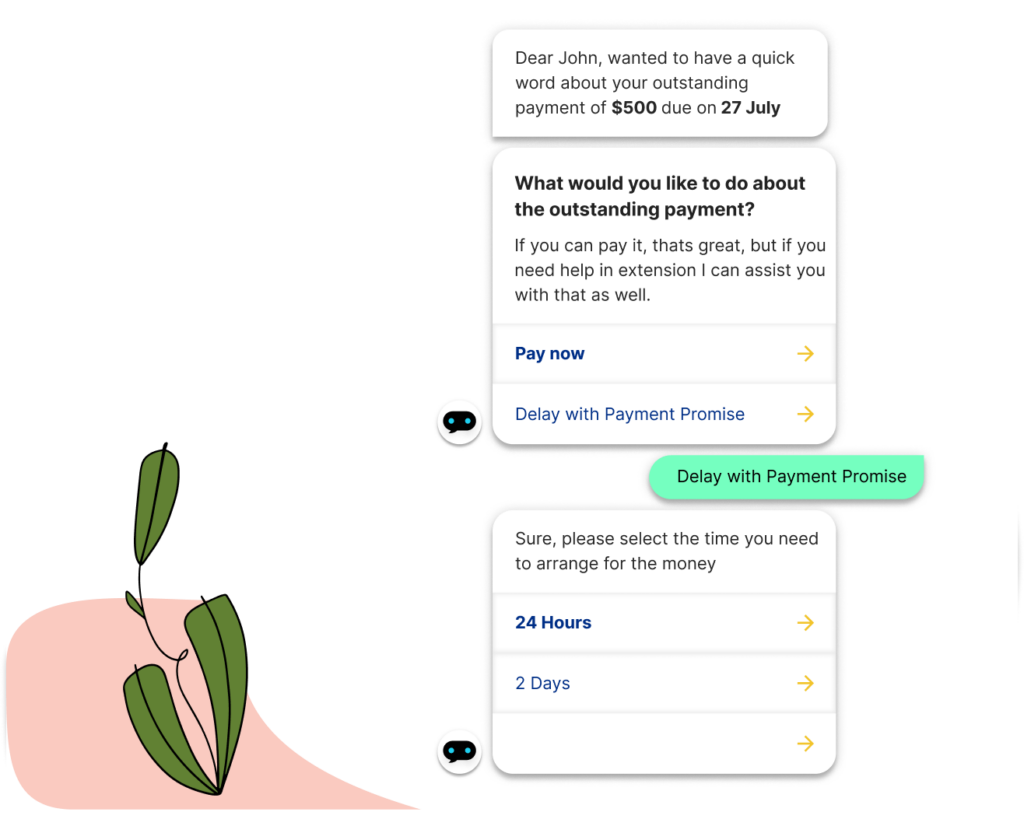

Debt Collection

Highly personalize your debt collection outreach program with Intelligent Virtual Assistants.

Enable highly efficient, personalized & customer friendly debt collection practices leading to a 200% improvement in debt collection rates.

Ensure 100% compliance in your debt collection practices.

Sales Assistant

Follow up with all your prospects in a highly personalized way and improve chances of conversion by up to 500%.

Track your prospects’ onboarding journey and follow up across any digital channel.

Appointment Scheduler

Enable customers to set up meetings with financial advisors without any hassle.

Customers and prospects will be able to schedule meetings with representatives of the financial institutions without waiting over the phone or email.

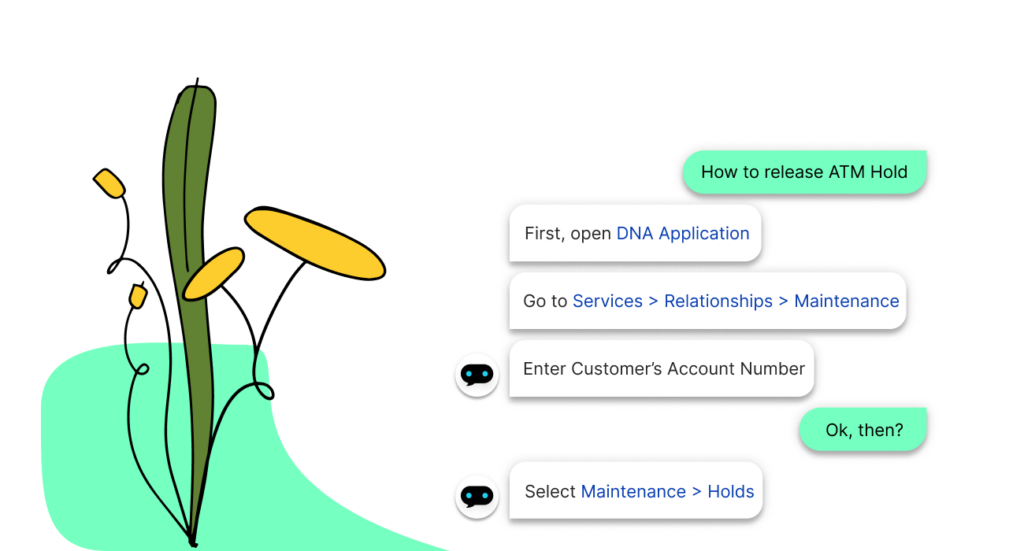

Branch Assistant

Enable Branch employees to assist customers better.

Help the branch employees to find right information instantly while assisting the customer.

Enable the branch employees in logging or tracking customer requests in an efficient way.

Call Center Assistant

Instant access to policies and procedures for your call center representatives (CSRs), thereby reducing their training time by 50%.

Help CSR find the right information instantly and drastically reduce Average Handling Time (AHT).

Ensure 100% consistency of information shared by CSRs and 100% compliance to company policies & procedures.

ADA & Accessibility

Get 100% compliant with the Americans with Disability Act(ADA) in days

Offer high quality banking experiences for all customers with Intelligent Virtual Assistants