Implementing Royce, UCU’s IVA

There are several highly promising solutions in the industry but only a handful of these solutions deliver value, anywhere close to the promise made pre-implementation.

Objective

Ensuring UCU’s Intelligent Virtual Assistant is set up to start driving maximum value in the shortest possible time.

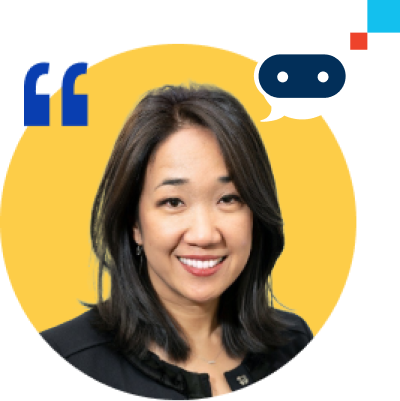

“The entire implementation process was very well planned and handled. We got a lot of value out of it as an organization.”

Estella Nagahashi

EVP, Chief Operating & Lending Officer, University Credit Union

The Implementation Journey

interface.ai set up a highly structured implementation journey to ensure UCU gets the maximum from their new IVA, Royce.

“The interface.ai team was very responsive across the entire process and the process was very well structured. It was a great learning experience for us and working with the interface.ai team, we were able to identify avenues that we could improve in our internal processes too.”

Chiasia Moua

Vice President, Operations, University Credit Union

Phases of Implementation

Quick Facts About Implementation Of Royce

After an extensive vendor selection process, UCU chose interface.ai as its partner for Intelligent Virtual Assistant Technology

- Royce was implemented in just 2 weeks – the fastest IVA implementation time in the industry

- Royce started delivering value from Day 1 after implementation

“I think the relationship between a vendor and a Financial Institution is very important and we at UCU have a great relationship with interface.ai. The interface.ai team is very understanding, quick to respond, and resolve any issues. This has made the overall process very enjoyable.”

Chiasia Moua

Vice President, Operations, University Credit Union

“In our industry, service is key. We have worked with some of the largest vendors, but we have hardly come across vendors who provide white-glove services such as the ones provided by interface.ai. They are setting new standards in the industry and I hope they continue to scale the same standard of service.”

Estella Nagahashi

EVP, Chief Operating & Lending Officer, University Credit Union

Launch Support

Support in Launch & Driving Adoption

interface.ai worked with UCU to ensure the launch of Royce is successful & there is sufficient adoption of Royce among the UCU members

Areas interface.ai collaborated with UCU

- Product Marketing

- Branding & Design

- Marketing Best Practices

- Go-To-Market Strategy

“interface.ai’s support across all the launch activities were valuable & much appreciated.”

Estella Nagahashi

EVP, Chief Operating & Lending Officer, University Credit Union

Post Launch Support

interface.ai ensures Royce is continuously improving through ongoing training and knowledge updates.

Inscope training

Updates to Machine Learning algorithms happen every day based on data gathered from customer interactions

New Scope Training

The AI system gets trained every week for any new scope based on member interactions

Collective learning – In our AI systems, learning occurs across multiple implementations to be able to answer the most questions that are not asked by customers yet

Knowledge update support

If UCU wishes to make any updates to the knowledge base, the request is processed within a 12 hour period

“The team at interface.ai does an excellent job on training & ensuring Royce is up to date. The team regularly shares reports on the current state of Royce and what we can look forward to.”

Chiasia Moua

Continuously Driving Value & ROI

interface.ai ensures Royce is continuously improving through ongoing training and knowledge updates.

“We have data now on what our members are asking – rather than just anecdotal information on what the members are looking at. That has been beneficial to make our products and services better.”

Estella Nagahashi

EVP, Chief Operating & Lending Officer, University Credit Union

Measuring the ROI of Royce

ROI Benchmarking

- Royce is set up to drive value & ROI for UCU from day 1

- Prior to launching, interface.ai has captured the benchmark of all the metrics Royce is expected to impact

- The impact of Royce is continuously tracked across these metrics

On-going evaluation of ROI

- We continuously compare the ROI metrics benchmarked to the new metric values and make any tweaks necessary to ensure rapid value generation

Learn more about Royce and interface.ai

In the news

AI Assistant helping small business Owners guage their eligibility for Small Business Administration Relief Funding

April 22, 2020

Fintech firms providing Free Techchnology during the CoronaVirus Crisis

April 3, 2020

Credit Unions begin new decade with Upgraded, Converted Systems

February 7, 2020 Learn how Royce was up in two weeks

Learn how Royce was up in two weeks